Mastering Trading with AutoML: Your Guide to Profitable Algorithmic Strategies

Automated Machine Learning (AutoML) plays a crucial role in crafting trading strategies driven by algorithms. In this tutorial, we’re going to walk you through AutoML, why it’s a game-changer in trading, and get you acquainted with two awesome AutoML tools, TPOT and H2O.ai.

AutoML takes care of all the stuff like handling data, tweaking features, choosing the best model, and fine-tuning parameters. Essentially, it’s the magic behind automating the most time-consuming parts of building machine learning models.

AutoML uses fancy algorithms and clever tricks to automatically search, test, and optimize machine learning models, making your life as a developer a whole lot easier. With AutoML at your side, you can focus on the exciting stuff, like defining the problem and tailoring features to your specific domain.

Benefits of AutoML in Algorithmic Trading

Algorithmic trading involves the use of computer algorithms to execute trading strategies based on predefined rules. Developing effective trading strategies requires extensive data analysis, feature engineering and model selection. AutoML can significantly streamline this process and offer several benefits:

- Time Efficiency: AutoML automates time-consuming tasks, such as data preprocessing and hyperparameter tuning, allowing traders to focus on strategy formulation and evaluation.

- Improved Performance: AutoML algorithms can explore a wide range of models and hyperparameters, leading to improved performance compared to manual model selection.

- Reduced Bias: AutoML techniques eliminate human bias in model selection and hyperparameter tuning, leading to more objective and robust trading strategies.

- Scalability: AutoML can handle large datasets and complex feature spaces, enabling traders to develop strategies that capture intricate market dynamics.

Popular AutoML Tools for Algorithmic Trading

There are several AutoML tools available that can be leveraged for algorithmic trading strategy development. In this tutorial, we will focus on two popular tools: TPOT and H2O.ai.

TPOT

TPOT (Tree-based Pipeline Optimization Tool) is an open-source AutoML library that uses genetic programming to optimize machine learning pipelines. It automatically explores a large search space of possible pipelines, including data preprocessing steps, feature selection and model selection.

H2O.ai

H2O.ai is another powerful AutoML platform that provides a range of automated machine learning capabilities. It offers an intuitive interface for building and deploying machine learning models, including support for time series analysis and algorithmic trading.

Setting up the Environment

Before we dive into the implementation of AutoML techniques for algorithmic trading strategy development, let’s set up our Python environment and install the necessary libraries.

Installing Required Libraries

To get started, we need to install the following libraries:

- numpy

- pandas

- yfinance

- tpot

- h2o

You can install these libraries using pip:

!pip install numpy pandas yfinance tpot h2oImporting Required Libraries

Once the libraries are installed, we can import them into our Python script:

import numpy as np

import pandas as pd

import yfinance as yf

from tpot import TPOTClassifier

import h2o

from h2o.automl import H2OAutoMLData Acquisition and Preprocessing

Now, we will acquire financial data using the yfinance library and preprocess it for algorithmic trading strategy development.

We will use the yfinance library to fetch historical financial data specifically for the ‘JPM’ (JPMorgan Chase & Co.) stock ticker. Let’s set the date range for this data retrieval:

tickers = ['JPM']

start_date = '2018-01-01'

end_date = '2023-08-31'

data = yf.download(tickers, start=start_date, end=end_date)Once we have the financial data, we need to preprocess it before feeding it into the AutoML models. Let’s perform some basic preprocessing steps:

# Remove missing values

data = data.dropna()

# Calculate daily returns

data['Return'] = data['Close'].pct_change()

# Calculate moving averages

data['MA_50'] = data['Close'].rolling(window=50).mean()

data['MA_200'] = data['Close'].rolling(window=200).mean()

# Create target variable

data['Target'] = np.where(data['Return'] > 0, 1, 0)

# Split data into training and testing sets

train_size = int(len(data) * 0.8)

train_data = data[:train_size].copy()

test_data = data[train_size:].copy()We will use the TPOT library to automatically generate and optimize trading strategies.

Defining the Problem

Before we can use TPOT, we need to define the problem we want to solve. In this case, our goal is to predict whether the daily return of a stock will be positive or negative based on historical data.

Training the TPOT Model

Let’s train the TPOT model using the training data:

# Separate features and target variable

X_train = train_data[['MA_50', 'MA_200']]

y_train = train_data['Target']

# Initialize TPOT classifier

tpot = TPOTClassifier(generations=10, population_size=50, verbosity=2)

# Train the model

tpot.fit(X_train, y_train)Once the model is trained, we can evaluate its performance on the testing data:

# Separate features and target variable

X_test = test_data[['MA_50', 'MA_200']]

y_test = test_data['Target']

# Evaluate the model

accuracy = tpot.score(X_test, y_test)

print(f"Accuracy: {accuracy}")Accuracy: 0.524390243902439Generating the Trading Strategy

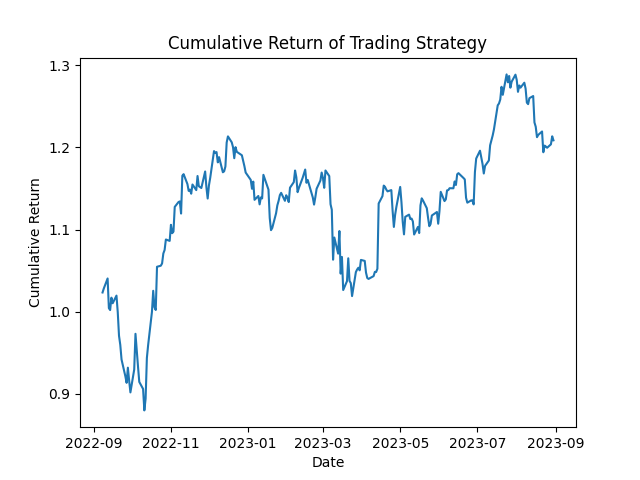

We will generate as an example a trading strategy based on the TPOT model’s predictions:

# Make predictions on the testing data

predictions = tpot.predict(X_test)

# Create trading signals based on the predictions

test_data.loc[:, 'Signal'] = np.where(predictions == 1, 1, -1)

# Calculate daily returns of the trading strategy

test_data.loc[:, 'Strategy_Return'] = test_data['Signal'] * test_data['Return']

# Calculate cumulative returns

test_data['Cumulative_Return_TPOT'] = (1 + test_data['Strategy_Return']).cumprod()

# Plot the cumulative returns

import matplotlib.pyplot as plt

plt.plot(test_data['Cumulative_Return_TPOT'])

plt.xlabel('Date')

plt.ylabel('Cumulative Return')

plt.title('Cumulative Return of Trading Strategy')

Using H2O.ai for Strategy Development

We will now explore the H2O.ai library and its AutoML capabilities for algorithmic trading strategy development.

Before we can use H2O.ai, we need to initialize the H2O cluster:

h2o.init()H2O.ai requires data to be in the H2O Frame format. Let’s convert our training and testing data to H2O Frames:

# Convert training data to H2O Frame

train_h2o = h2o.H2OFrame(train_data)

# Convert testing data to H2O Frame

test_h2o = h2o.H2OFrame(test_data)Training the H2O AutoML Model

Let’s train the H2O AutoML model using the training data:

# Define features and target variable

features = ['MA_50', 'MA_200']

target = 'Target'

# Train the AutoML model

aml = H2OAutoML(max_models=20, seed=1)

aml.train(x=features, y=target, training_frame=train_h2o)Once the model is trained, we can evaluate its performance on the testing data:

# Evaluate the model

leaderboard = aml.leaderboard

print(leaderboard)model_id auc logloss aucpr mean_per_class_error rmse mse

DeepLearning_grid_3_AutoML_1_20230903_212353_model_1 0.532714 0.698202 0.517747 0.5 0.502349 0.252354

GLM_1_AutoML_1_20230903_212353 0.532598 0.69102 0.508643 0.498992 0.498938 0.248939

DeepLearning_grid_2_AutoML_1_20230903_212353_model_1 0.532129 0.695525 0.517005 0.5 0.50097 0.250971

DeepLearning_grid_3_AutoML_1_20230903_212353_model_2 0.516846 0.693306 0.50998 0.49496 0.500078 0.250078

XRT_1_AutoML_1_20230903_212353 0.514925 0.859604 0.512393 0.49496 0.551758 0.304437

DeepLearning_grid_1_AutoML_1_20230903_212353_model_2 0.514667 0.700916 0.508606 0.498009 0.503654 0.253667

DRF_1_AutoML_1_20230903_212353 0.511943 0.970723 0.516976 0.5 0.560415 0.314065

GBM_5_AutoML_1_20230903_212353 0.51122 0.711706 0.489317 0.5 0.508239 0.258307

DeepLearning_grid_1_AutoML_1_20230903_212353_model_1 0.510156 0.698407 0.505102 0.5 0.502529 0.252536

GBM_grid_1_AutoML_1_20230903_212353_model_2 0.506711 0.705076 0.490292 0.497001 0.505595 0.255626

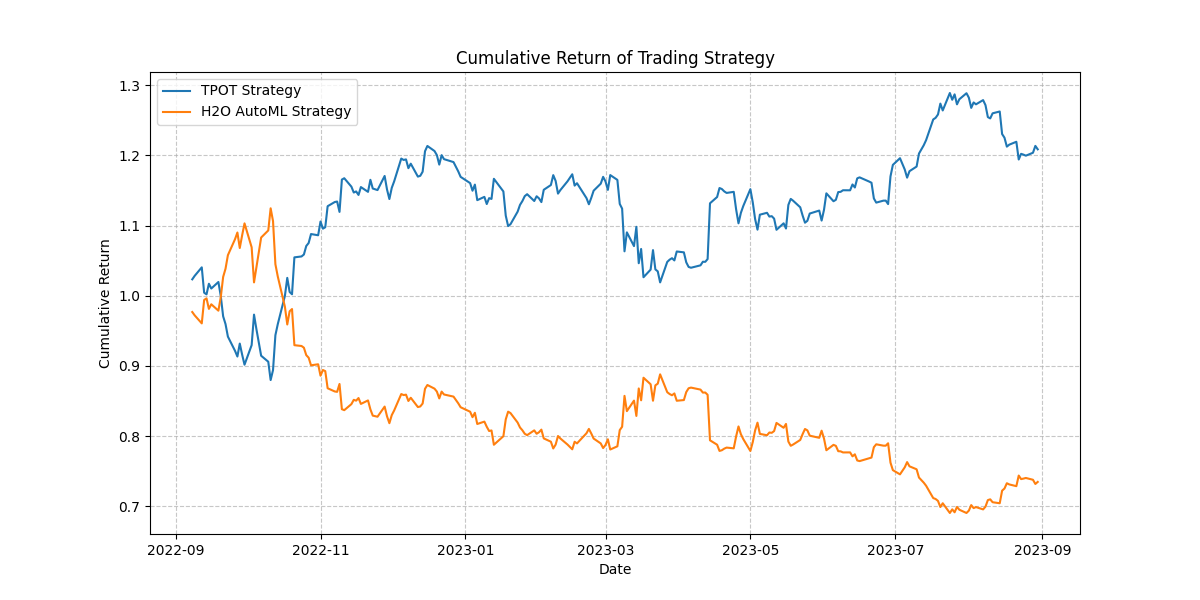

[22 rows x 7 columns]Generating the Trading Strategy

Let’s generate the trading strategy based on the H2O AutoML model’s predictions:

# Make predictions on the testing data

predictions = aml.predict(test_h2o)

# Created DF from predictions h20frame

predictions_df = predictions.as_data_frame()

# Create trading signals based on the predictions

test_data.loc[:, 'Signal'] = np.where(predictions_df['predict'] == '1', 1, -1)

# Calculate daily returns of the trading strategy

test_data['Strategy_Return'] = test_data['Signal'] * test_data['Return']

# Calculate cumulative returns

test_data['Cumulative_Return_H2O'] = (1 + test_data['Strategy_Return']).cumprod()

# Plot the cumulative returns

import matplotlib.pyplot as plt

plt.figure(figsize=(12, 6))

plt.plot(test_data[['Cumulative_Return_TPOT', 'Cumulative_Return_H2O']])

plt.xlabel('Date')

plt.ylabel('Cumulative Return')

plt.title('Cumulative Return of Trading Strategy')

plt.grid(True, linestyle='--', alpha=0.7)

plt.legend(['TPOT Strategy', 'H2O AutoML Strategy'])

Conclusion

In this tutorial, we explored the concept of AutoML and its relevance in algorithmic trading strategy development. We discussed the benefits of using AutoML techniques and introduced two popular tools, TPOT and H2O.ai. to automatically generate and optimize trading strategies.

By leveraging AutoML techniques, traders can streamline the strategy development process, improve performance and reduce bias. AutoML tools like TPOT and H2O.ai provide powerful capabilities for developing robust and profitable trading strategies.

Remember to experiment with different features, models and hyperparameters to further enhance the performance of your trading strategies.

Become a Medium member today and enjoy unlimited access to thousands of Python guides and Data Science articles! For just $5 a month, you’ll have access to exclusive content and support as a writer. Sign up now using my link and I’ll earn a small commission at no extra cost to you.

References

- TPOT Documentation: https://epistasislab.github.io/tpot/

- H2O.ai Documentation: https://docs.h2o.ai/