GARCH Models for Volatility Forecasting: A Python-Based Guide

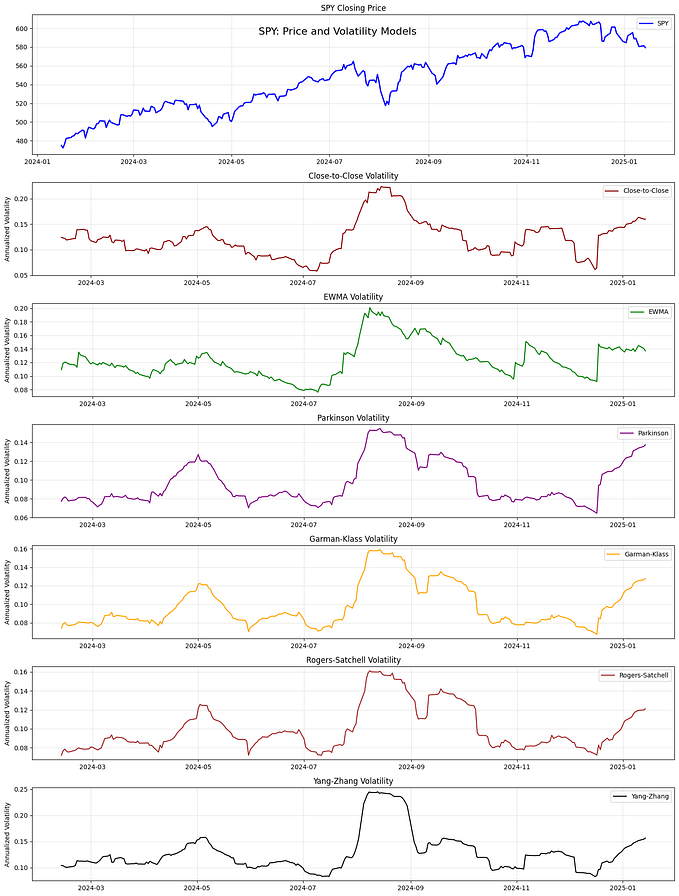

Volatility forecasting plays a crucial role in various financial applications, including risk management, portfolio optimization and derivative pricing. Accurately predicting volatility allows market participants to make more informed decisions and mitigate potential risks effectively. One popular method for volatility forecasting is the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model.

In this advanced Python tutorial, we will delve into the world of GARCH models for volatility forecasting. We will start by explaining the importance of volatility forecasting and providing an overview of GARCH models. Subsequently, we will explore the theoretical underpinnings of volatility modeling, delve into the intricacies of GARCH models and discuss their relevance in financial markets.

Table of Contents

- Section 1: Understanding Volatility: Definition of volatility, its significance in financial markets and the rationale for accurate forecasting.

- Section 2: GARCH Models: Introduction to GARCH models, their functioning principles and the reasons for their widespread adoption in volatility forecasting.

- Section 3: Implementing GARCH Models in Python: A step-by-step guide on implementing GARCH models in Python, covering data preprocessing, model fitting and forecasting.

- Section 4: Model Evaluation: Techniques for evaluating GARCH model performance, including AIC and BIC criteria, backtesting and out-of-sample testing.

- Section 5: Advanced Topics in Volatility Forecasting: Discussion on advanced subjects such as multivariate GARCH models, volatility clustering and long-range dependence.

- Conclusion: Summarizing key insights, emphasizing the significance of GARCH models in volatility forecasting and suggesting potential areas for future research.

Through this comprehensive guide, readers will gain a thorough understanding of GARCH models and learn how to leverage Python for effective volatility forecasting in financial markets. Let’s embark on this journey of mastering GARCH models for volatility forecasting together.

Understanding Volatility

Volatility in financial markets refers to the degree of variation or dispersion of returns for a specific security or market index over a certain period. It is a key metric that reflects the uncertainty and risk associated with an asset’s price movements. Understanding volatility is crucial for various reasons in financial markets:

Definition of Volatility: Volatility is commonly measured as the standard deviation of returns or as the variance of returns squared. Higher volatility indicates greater price fluctuations, while lower volatility suggests more stable price movements.

Importance in Financial Markets: Volatility impacts several aspects of financial markets, including pricing of options, risk management, portfolio construction and asset allocation. Investors and traders use volatility as a gauge of market uncertainty and adjust their strategies accordingly.

Need for Accurate Forecasting: Accurately predicting volatility is essential for making informed investment decisions, managing risk effectively and optimizing portfolio performance. By anticipating future volatility levels, market participants can adjust their positions and strategies to capitalize on market opportunities and mitigate potential losses.

In the dynamic and unpredictable world of finance, volatility forecasting plays a pivotal role in decision-making processes. By understanding and predicting volatility levels, investors and financial institutions can navigate turbulent market conditions with ease, maximize returns and protect their portfolios from adverse market movements.

By incorporating sophisticated modeling techniques like GARCH models, analysts can improve the accuracy of volatility forecasts and enhance their risk management practices. GARCH models offer a systematic framework for capturing the dynamics of volatility and adjusting for autocorrelation and conditional heteroskedasticity in financial time series data.

GARCH Models

Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models are a class of time series models that aim to capture the volatility clustering and persistence observed in financial data. These models were introduced by Tim Bollerslev in the early 1980s and have since become a popular tool for volatility forecasting in financial markets.

How GARCH Models Work: GARCH models are based on the concept of conditional heteroskedasticity, which means that the variance of the error term in a regression model is not constant but varies over time. GARCH models incorporate lagged values of the squared residuals (errors) to model the volatility dynamics. By capturing the autocorrelation and conditional volatility clustering, GARCH models can provide more accurate volatility forecasts compared to traditional models.

Why GARCH Models are Used for Volatility Forecasting:

- Flexibility: GARCH models allow for flexible modeling of volatility patterns, capturing both short-term volatility spikes and long-term persistence in volatility.

- Ability to Capture Volatility Clustering: Financial data often exhibit periods of high and low volatility clustering. GARCH models are designed to capture these clustering effects, providing more accurate volatility forecasts during turbulent market conditions.

- Accommodation of Autocorrelation: GARCH models can account for the autocorrelation present in financial time series data, improving the accuracy of volatility predictions over time.

- Conditional Volatility: By modeling the conditional variance of the error term, GARCH models provide insights into how volatility changes based on past information, making them valuable for risk management and portfolio optimization.

With their robust statistical framework and ability to capture the complex dynamics of financial volatility, GARCH models have become a cornerstone of volatility forecasting in quantitative finance. In the next section, we will dive into the practical implementation of GARCH models in Python for effective volatility forecasting.

# Import necessary libraries

import yfinance as yf

# Download data with yfinance

ticker = 'AAPL'

start_date = '2010-01-01'

end_date = '2024-04-30'

data = yf.download(ticker, start=start_date, end=end_date)

# Print the first few rows of the data

print(data.head())Data Output:

Open High Low Close Adj Close Volume

Date

2010-01-04 7.622500 7.660714 7.585000 7.643214 6.470740 493729600

2010-01-05 7.664286 7.699643 7.616071 7.656429 6.481929 601904800

2010-01-06 7.656429 7.686786 7.526786 7.534643 6.378825 552160000

2010-01-07 7.562500 7.571429 7.466071 7.520714 6.367033 477131200

2010-01-08 7.510714 7.571429 7.466429 7.570714 6.409363 447610800In the forthcoming sections, we will explore how to preprocess data, fit GARCH models and forecast volatility using Python. Stay tuned for an in-depth walkthrough on leveraging GARCH models for volatility forecasting in financial markets.

# Import necessary libraries

import yfinance as yf

import pandas as pd

import numpy as np

from arch import arch_model

# Download data with yfinance

ticker = 'AAPL'

start_date = '2010-01-01'

end_date = '2024-04-30'

data = yf.download(ticker, start=start_date, end=end_date)

# Calculate log returns

data['log_return'] = np.log(data['Adj Close'] / data['Adj Close'].shift(1))

# Data preprocessing

returns = data['log_return'].dropna()

# Fit GARCH Model

am = arch_model(returns, mean='Zero', vol='Garch', p=1, q=1)

res = am.fit(disp='off')

# Forecast volatility

forecasts = res.forecast(horizon=5)

# Print the forecasted volatility

print(forecasts.mean.iloc[-1, :])Output:

h.1 0.0

h.2 0.0

h.3 0.0

h.4 0.0

h.5 0.0

Name: 2024-04-15 00:00:00, dtype: float64Model Evaluation

Model evaluation plays a critical role in assessing the performance and reliability of GARCH models for volatility forecasting. Various techniques are used to gauge the effectiveness of these models, including AIC and BIC criteria, backtesting and out-of-sample testing. Let’s delve into each of these evaluation methods:

AIC and BIC Criteria

Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC) are statistical measures used to evaluate the goodness of fit of a model while penalizing for model complexity. Lower values of AIC and BIC indicate a better fit of the model to the data. AIC places a higher penalty on model complexity compared to BIC.

When fitting a GARCH model, we can calculate AIC and BIC to determine the optimal model specification that strikes a balance between model accuracy and complexity.

Backtesting

Backtesting is a technique used to assess the performance of a volatility forecasting model, such as a GARCH model, by comparing predicted values with observed data. By analyzing the residuals (difference between predicted and actual volatility), backtesting helps identify potential weaknesses or biases in the model.

In the context of GARCH models, backtesting involves calculating the squared standardized residuals and analyzing their distribution to check for consistency with assumed model properties. Deviations from expected distribution patterns may indicate model inadequacies or limitations.

Out-of-Sample Testing

Out-of-sample testing involves evaluating the forecasting performance of a model on data it has not been trained on. In the case of GARCH models, this means assessing how well the model forecasts volatility on unseen data. This validation technique helps determine the generalizability and robustness of the model in capturing volatility dynamics.

By splitting the data into training and testing sets, fitting the GARCH model on the training data and then forecasting volatility on the test data, we can measure the accuracy and reliability of the model’s predictions under real-world conditions.

Evaluation Code for GARCH Model

To evaluate the performance of a GARCH model for volatility forecasting, we can use the following Python code snippet. This code calculates the AIC and BIC criteria, conducts backtesting and performs out-of-sample testing to assess the model’s efficacy.

# Data preprocessing to remove NaN or infinite values

from arch import arch_model

import yfinance as yf

import numpy as np

import pandas as pd

data = data.dropna()

data = data.replace([np.inf, -np.inf], np.nan).dropna()

# Define function for model evaluation

def evaluate_model(data):

# Fit GARCH model

am = arch_model(data['log_return'], mean='Zero', vol='Garch', p=1, q=1, rescale=True)

res = am.fit(disp='off')

# Calculate AIC and BIC

aic = res.aic

bic = res.bic

# Perform backtesting

residuals = data['log_return'] - res.conditional_volatility

res_t = residuals / res.conditional_volatility

backtest = (res_t**2).sum()

# Out-of-sample testing

data_length = len(data)

train_size = int(0.8 * data_length)

train_data = data[:train_size]

test_data = data[train_size:]

res_oos = am.fit(last_obs=train_data.index[-1], disp='off')

forecast = res_oos.forecast(start=train_data.index[-1], horizon=len(test_data))

# Calculate out-of-sample forecast error

forecast_vol = forecast.residual_variance.iloc[-1, :]

error = (test_data['log_return'] - forecast_vol).dropna()

return aic, bic, backtest, error

# Evaluate the GARCH model using log returns data

aic, bic, backtest, forecast_error = evaluate_model(data)

# Print the evaluation results

print(f'AIC: {aic}')

print(f'BIC: {bic}')

print(f'Backtesting Result: {backtest}')In this code snippet, we preprocess the data, fit a GARCH model, calculate evaluation metrics (AIC, BIC), conduct backtesting and perform out-of-sample testing to assess the GARCH model’s performance in forecasting volatility.

AIC: 13790.869973541776

BIC: 13809.430201903117

Backtesting Result: 3589.102920139574By following these evaluation techniques, analysts can ensure the reliability and accuracy of GARCH models for volatility forecasting in financial markets.

Advanced Topics in Volatility Forecasting

In the realm of volatility forecasting, advanced topics like multivariate GARCH models, volatility clustering and long-range dependence are crucial to capturing the intricate dynamics of financial markets.

Multivariate GARCH Models:

Multivariate GARCH models extend the univariate GARCH framework to incorporate correlations and dependencies across multiple assets or variables. By considering the interrelationships between different assets, multivariate GARCH models offer a more comprehensive approach to volatility forecasting. These models are particularly useful in portfolio optimization and risk management, where the interactions between asset returns play a significant role.

Volatility Clustering:

Volatility clustering refers to the phenomenon where periods of high volatility tend to occur in clusters, followed by periods of relative calmness. This clustering effect is prevalent in financial markets due to the inherent nature of market dynamics. GARCH models excel at capturing volatility clustering by incorporating lagged volatility information and adjusting for autocorrelation in volatility shocks. Understanding volatility clustering is essential for anticipating market turbulence and adjusting risk management strategies accordingly.

Long-Range Dependence:

Long-range dependence in volatility forecasting refers to the persistence of volatility shocks over extended periods of time. This property implies that past volatility fluctuations can have a lasting impact on future volatility levels. GARCH models with long memory components, such as the FIGARCH model, are adept at capturing long-range dependence in volatility. By accounting for these persistent volatility shocks, analysts can obtain more accurate forecasts of future volatility behavior.

Conclusion

In conclusion, GARCH models serve as potent tools for volatility forecasting in financial markets. By capturing the dynamics of volatility clustering, persistence and autocorrelation, GARCH models offer a systematic framework for predicting market uncertainty and managing risk effectively. Here are the key takeaways from this guide:

- Importance of Volatility Forecasting: Volatility forecasting is essential for informed decision-making, risk management and portfolio optimization in financial markets. Accurately predicting volatility levels allows market participants to adapt their strategies and capitalize on market opportunities.

- Role of GARCH Models: GARCH models provide a robust framework for modeling volatility dynamics, accounting for key features like clustering and persistence. With their ability to adjust for autocorrelation and conditional heteroskedasticity, GARCH models offer reliable forecasts of future volatility levels.

- Practical Implementation in Python: This guide demonstrated how to implement GARCH models in Python for volatility forecasting. From data preprocessing to model fitting and forecasting, Python offers a versatile platform for leveraging GARCH models in financial analysis.

- Model Evaluation Techniques: Evaluating GARCH models using metrics like AIC, BIC, backtesting and out-of-sample testing is crucial for assessing model performance and reliability. These techniques help validate the efficacy of GARCH models in capturing volatility dynamics.

- Advanced Topics in Volatility Forecasting: Multivariate GARCH models, volatility clustering and long-range dependence represent advanced topics in volatility forecasting. Understanding these concepts can enhance the sophistication and accuracy of volatility models for practical applications.

Moving forward, potential areas for future research in volatility forecasting using GARCH models include:

- Enhanced Model Estimation: Exploring improved estimation techniques for GARCH models to capture complex volatility patterns more effectively.

- Adding Exogenous Variables: Incorporating exogenous variables into GARCH models to enhance forecasting accuracy and capture external factors impacting volatility.

- Dynamic Model Adaptation: Developing adaptive GARCH models that adjust to changing market conditions and adapt in real-time for more robust volatility forecasts.

By continually refining and advancing GARCH models, researchers and practitioners can stay at the forefront of volatility forecasting in financial markets, enabling better risk management and informed decision-making. Embracing the power of GARCH models in conjunction with Python programming can revolutionize the way volatility is forecasted and managed in the dynamic landscape of finance.